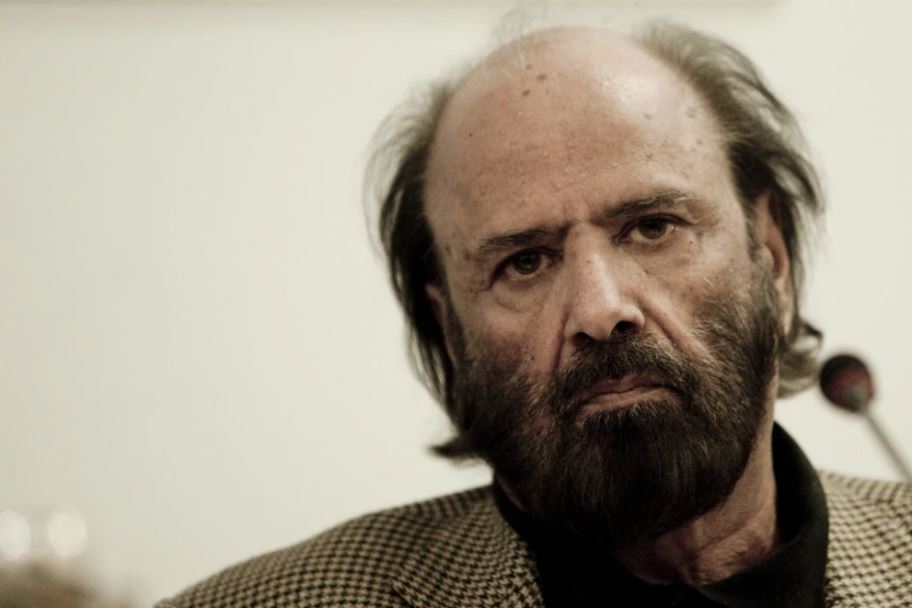

By Peter Marcuse

“What is called the “subprime mortgage crisis” reflects a fundamental crisis in the housing system of the United States. Subprime mortgages are mortgages given to borrowers whose incomes or credit ratings or the equity in whose property does not justify a conventional mortgage at the prevailing interest rate on prevailing terms. Instead, subprime mortgages carry a higher interest rate and are seen as having a greater risk of foreclosure for nonpayment.

The subprime mortgage crisis is not a crisis of liquidity in the mortgage market, or a failure of regulation, nor is it the same as the crisis of Fannie Mae and Freddie Mac, two large government-sponsored corporations active in the secondary mortgage market, which is a different crisis with which the subprime market crisis is often confused. It is rather the result of the inability of the housing market system to provide adequate and affordable housing for large numbers of Americans, and of the ideological commitment implicit in that system to private individual homeownership as the incarnation of the American Dream for the masses…”

To read the full article click here.